Kavak Financing

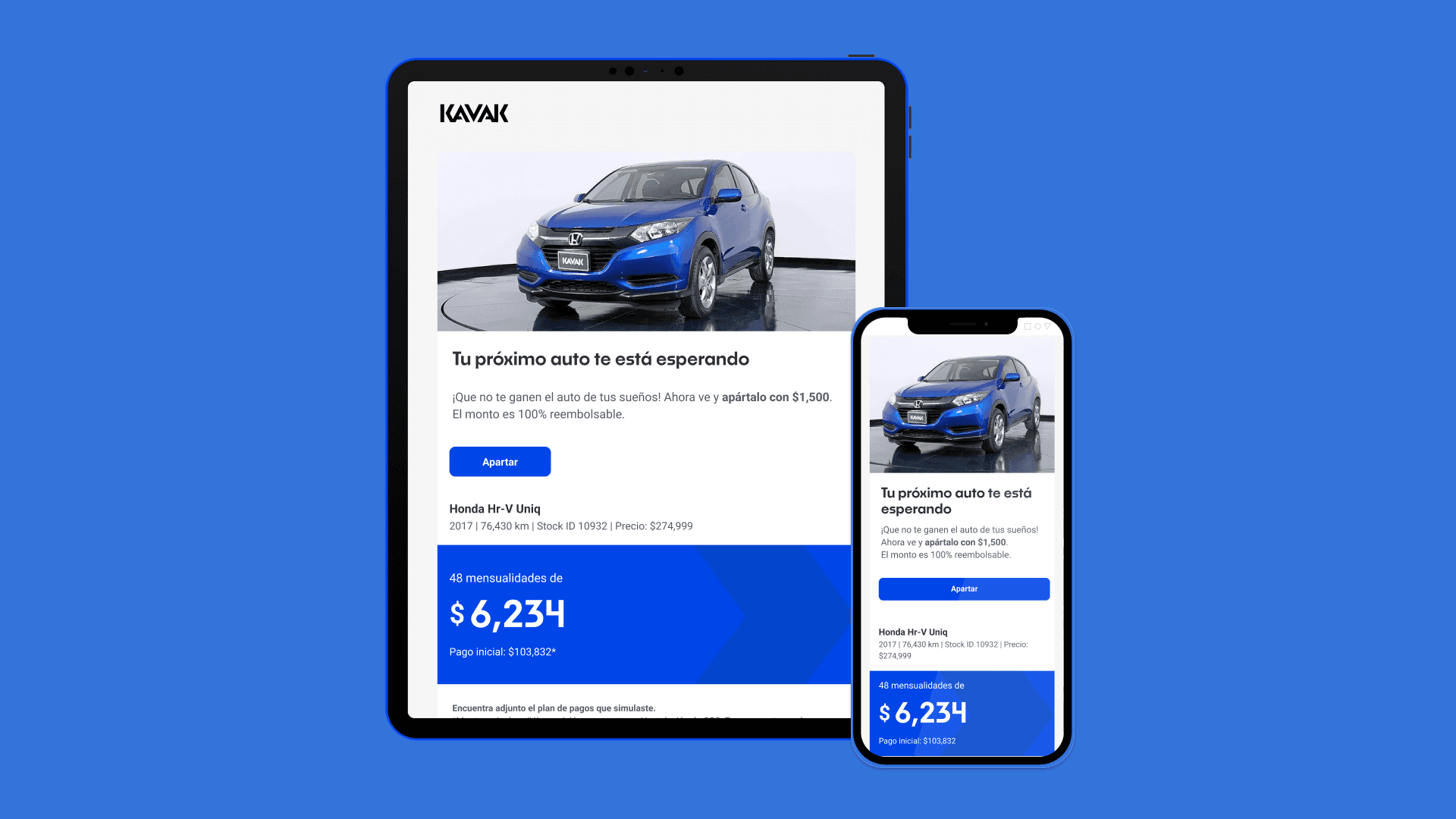

Buy a car 100% online, with a financing plan.

Role

Senior UX Designer

Sectors

Technology, Automotive, Financing

Disciplines

UX Design, UX Research, UI Design

Teams

Product, IT, Business, Legal, UX (content, research and UX design)

Date

2020-2022

About

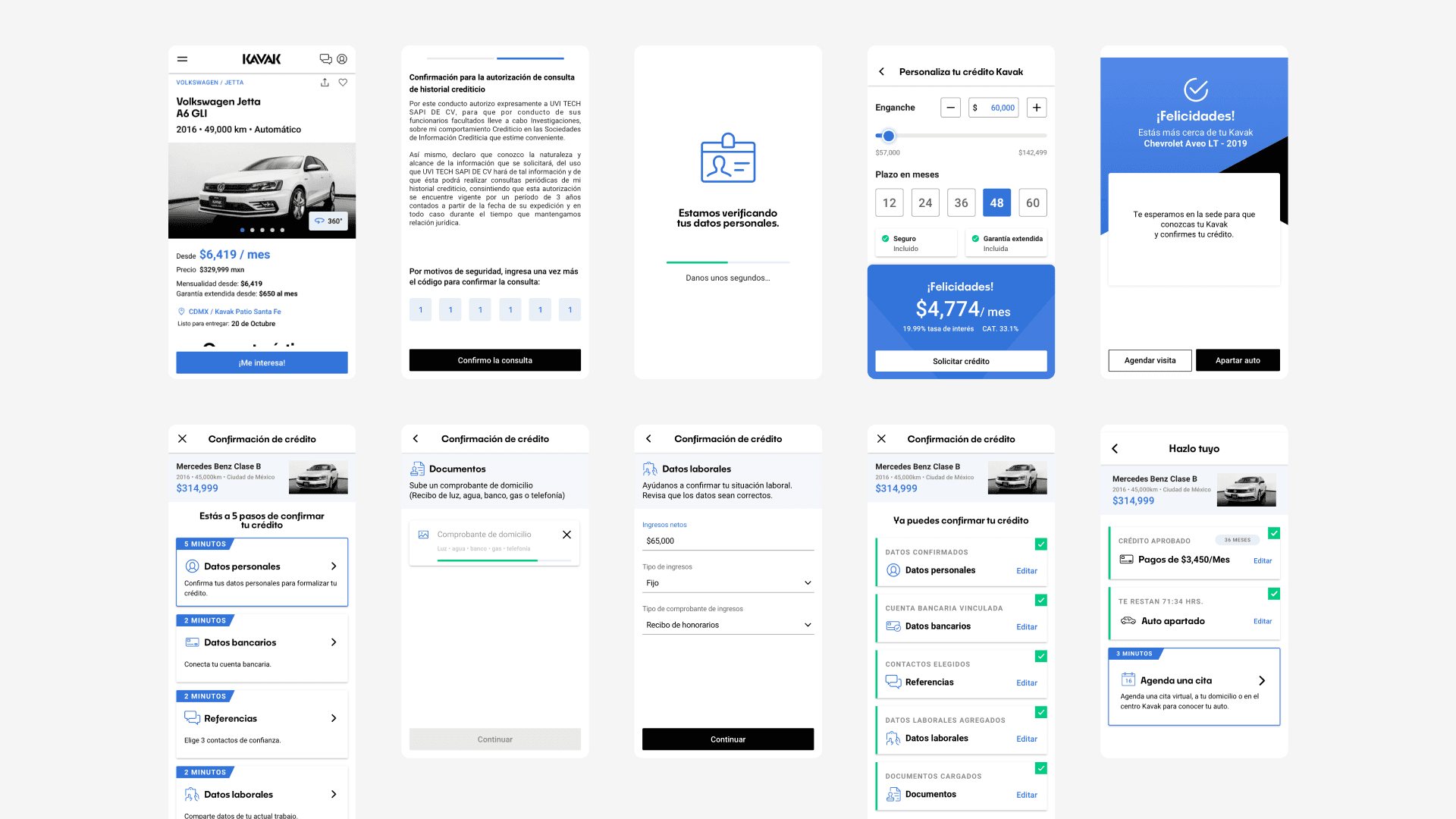

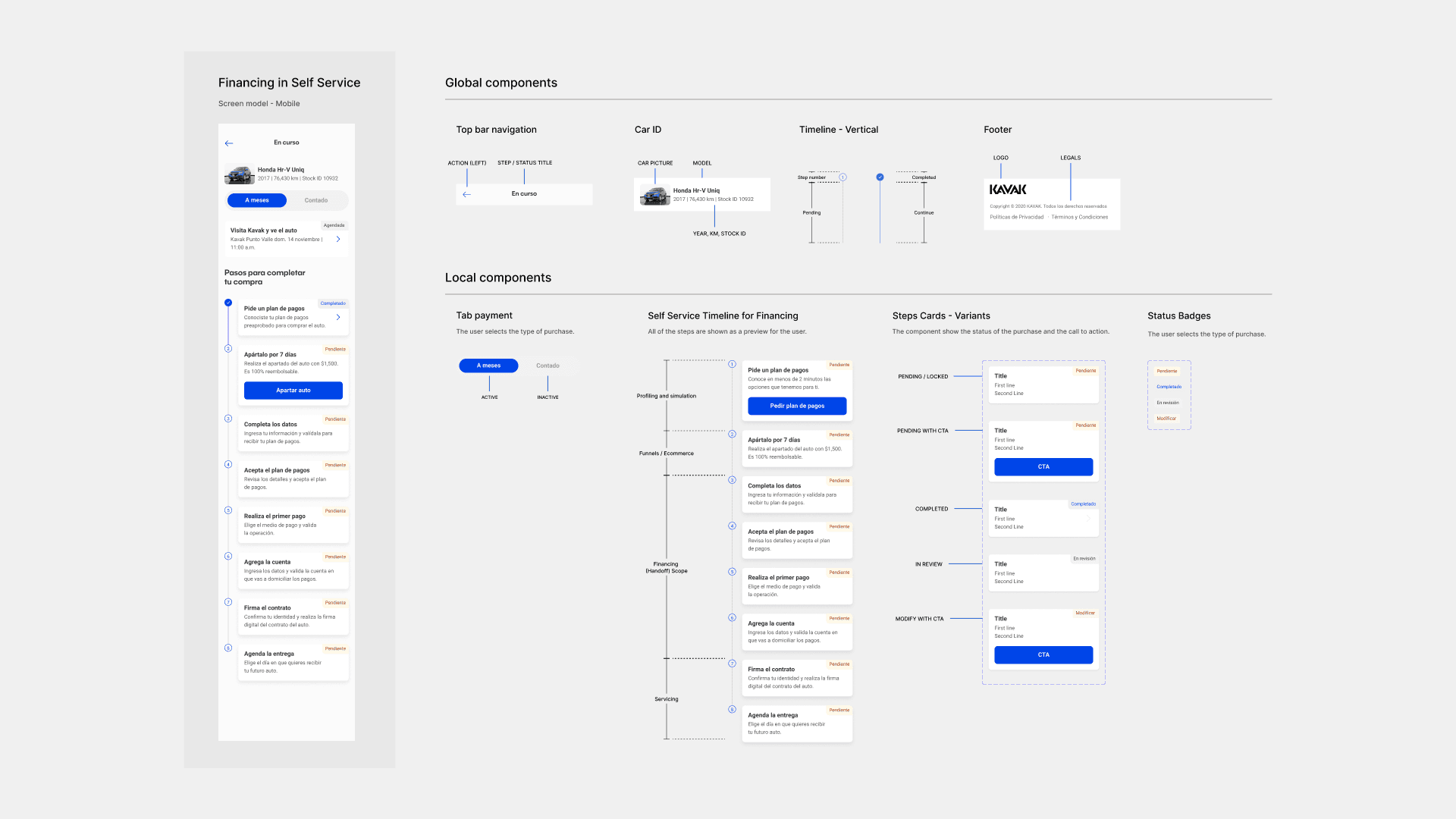

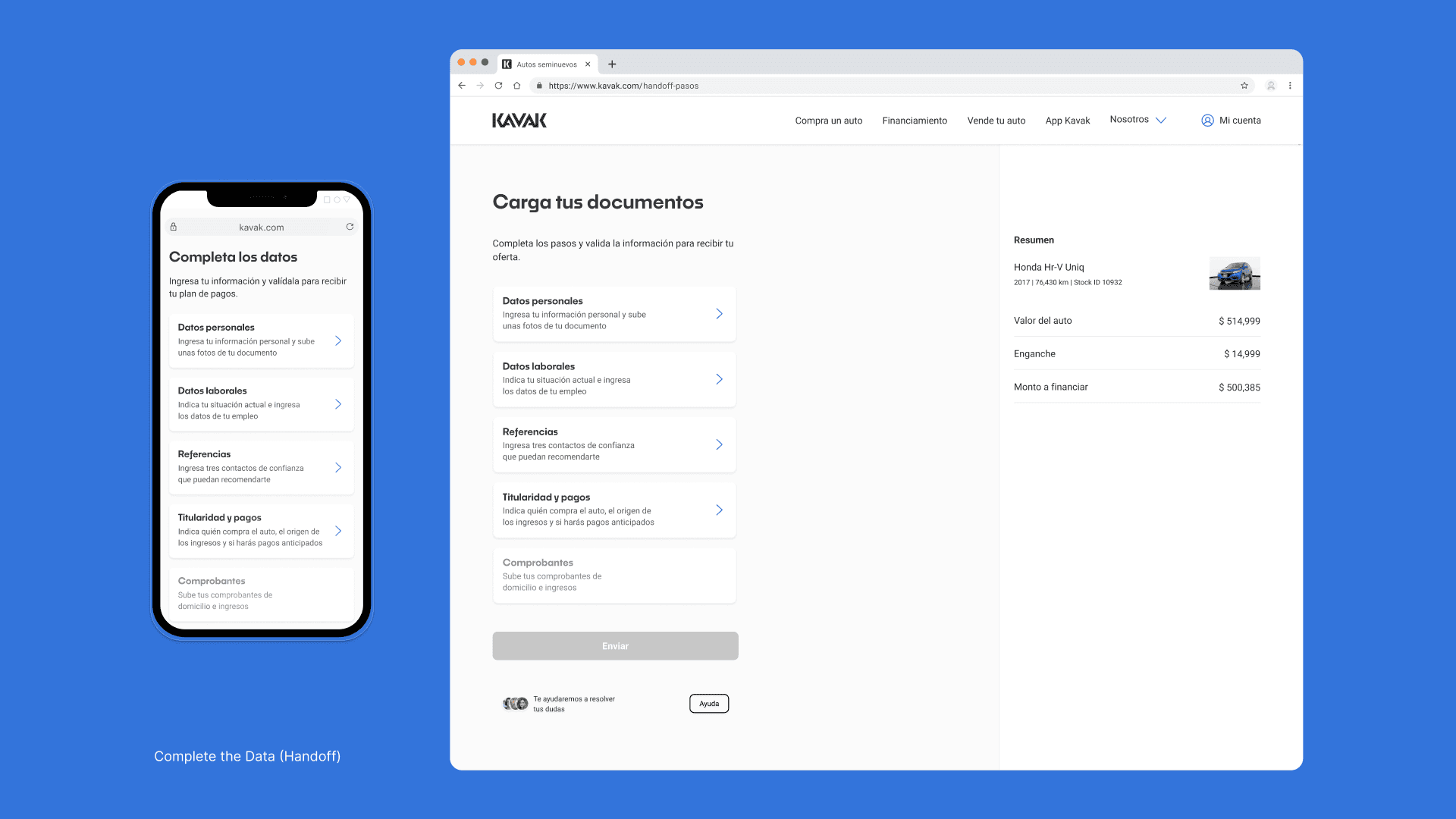

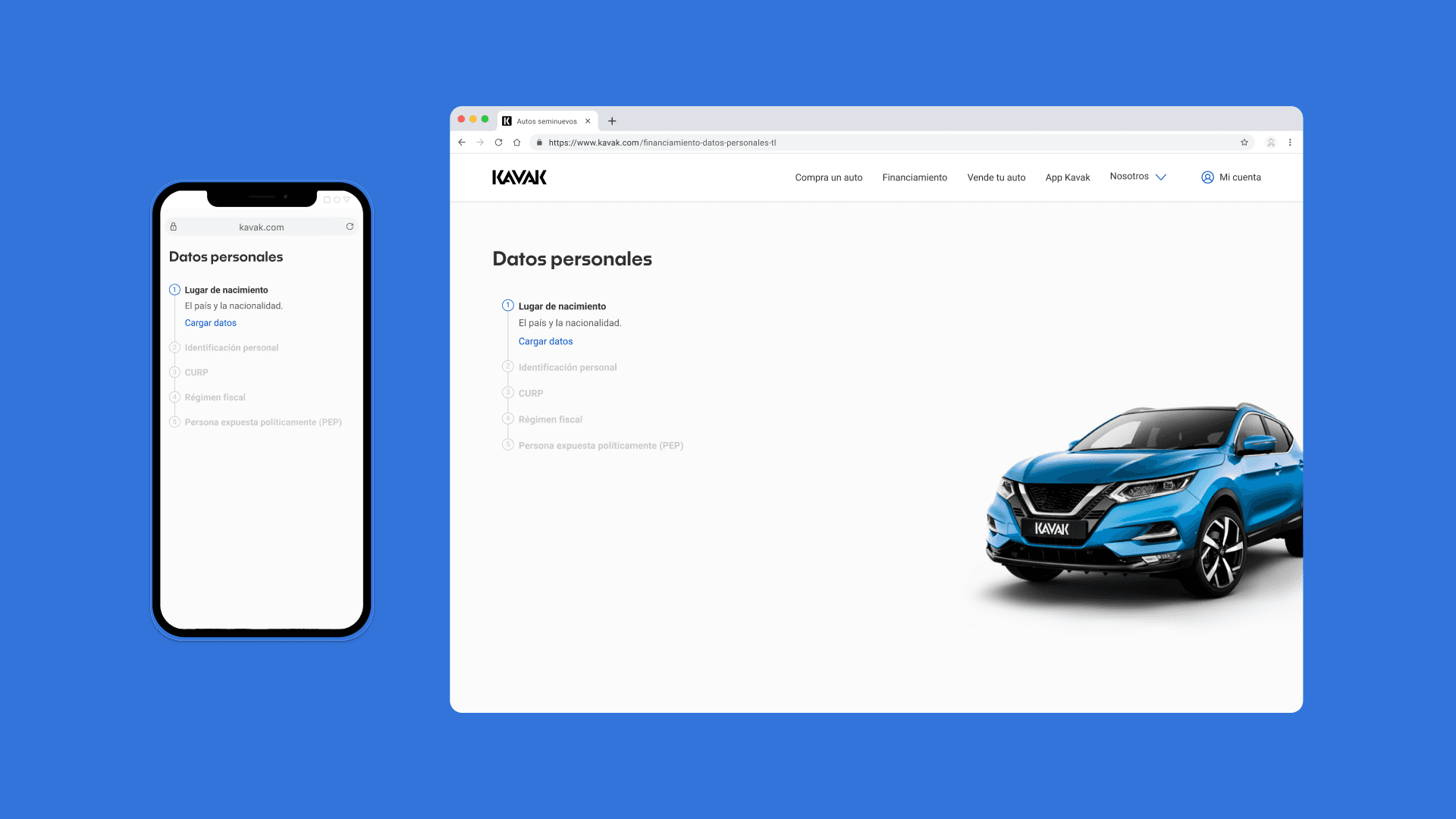

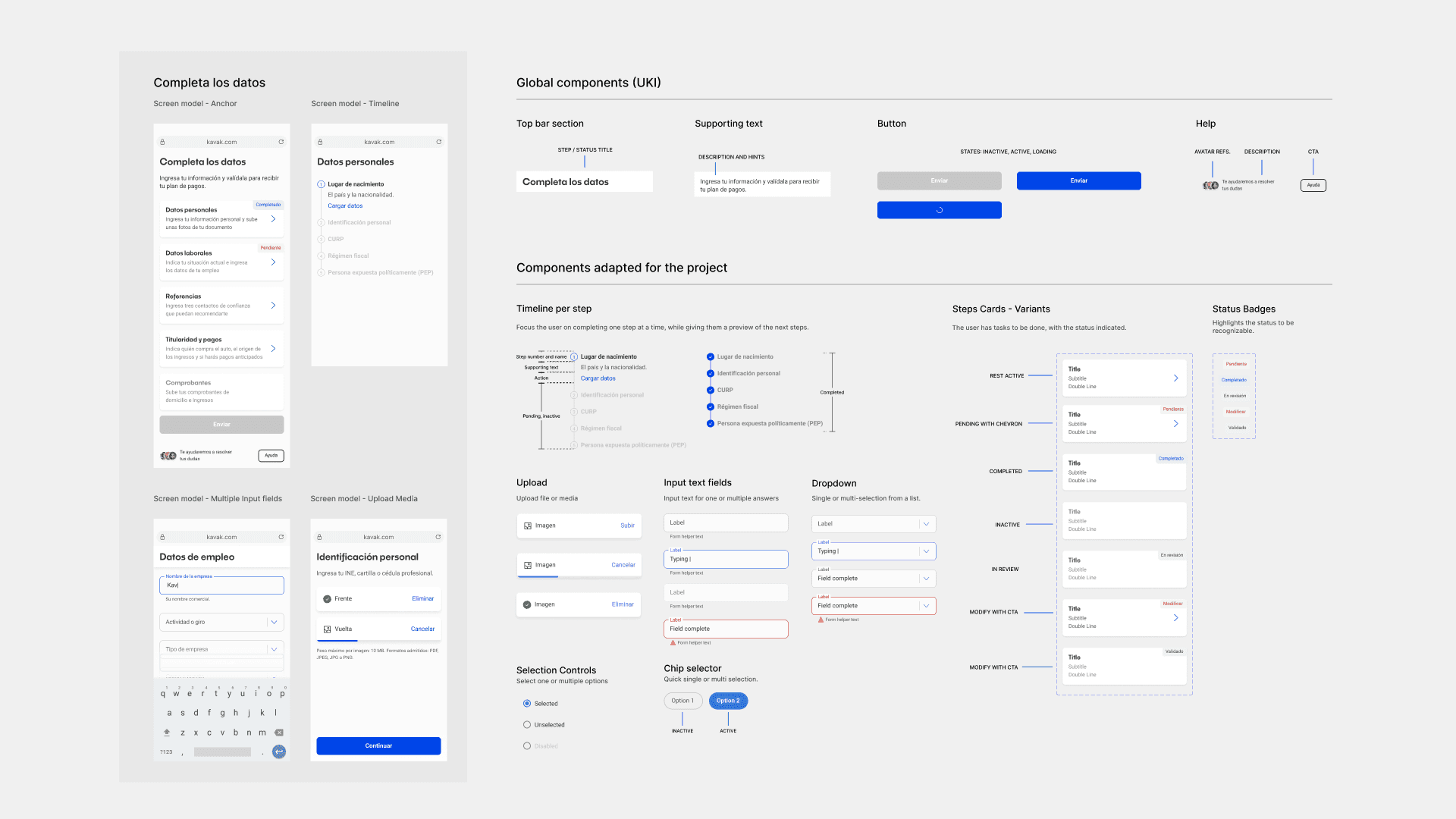

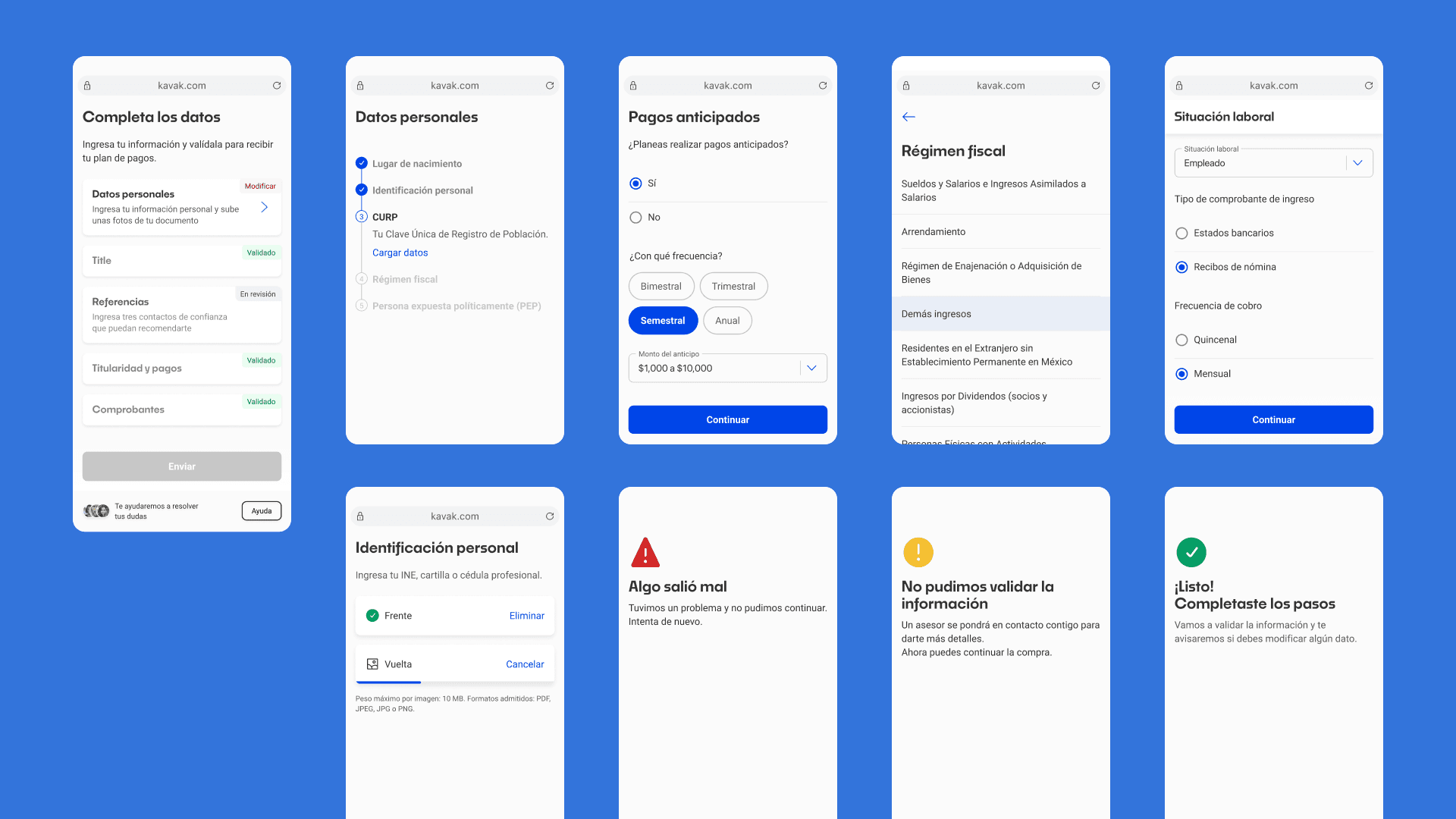

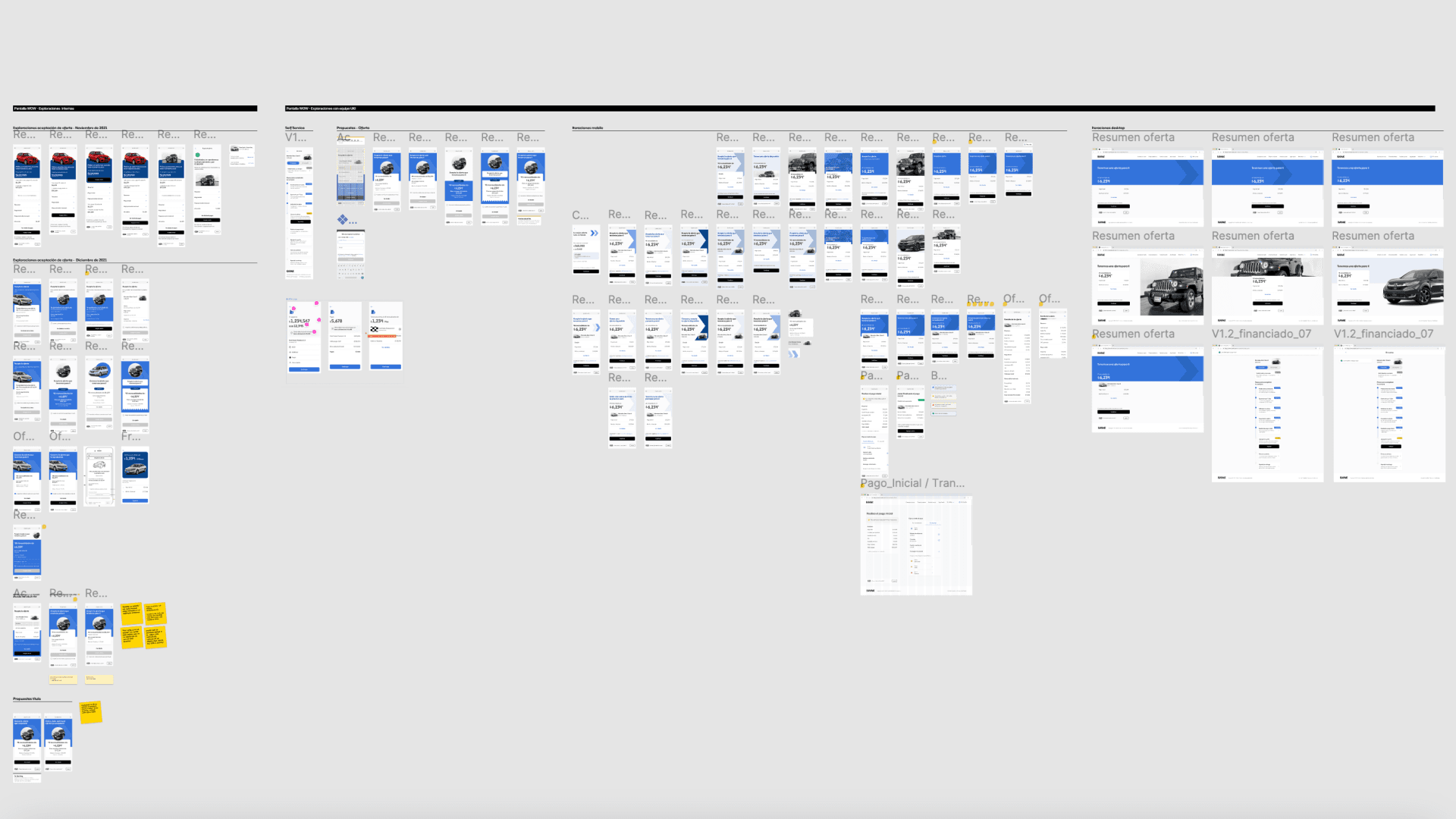

I led the end-to-end redesign of Kavak’s financing journey, applying a Design Thinking framework to address user needs, streamline complex workflows, and enhance customer satisfaction across multiple touchpoints. This project spanned six key areas, showcasing my ability to design intuitive, scalable solutions that meet both user expectations and business goals.

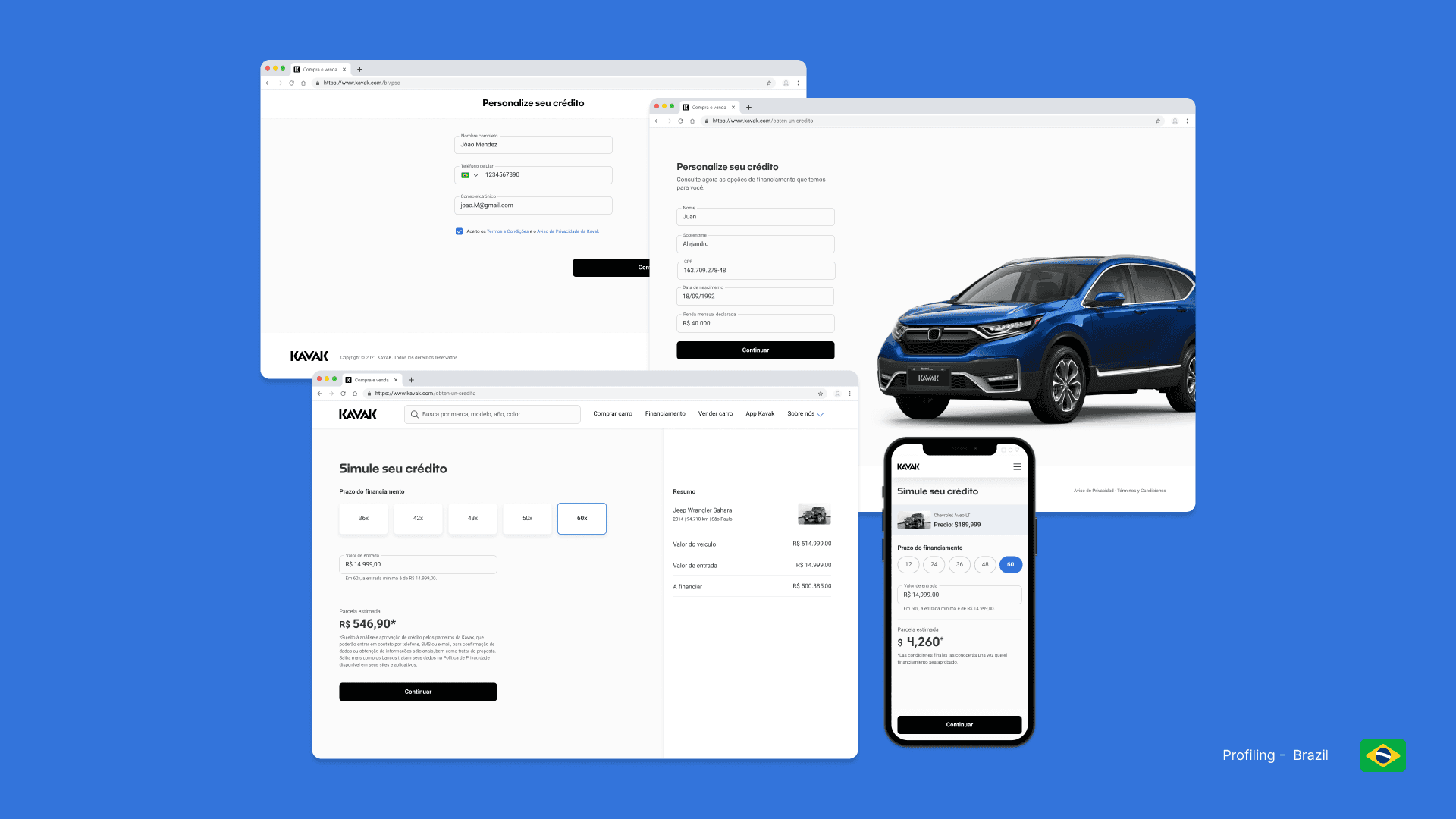

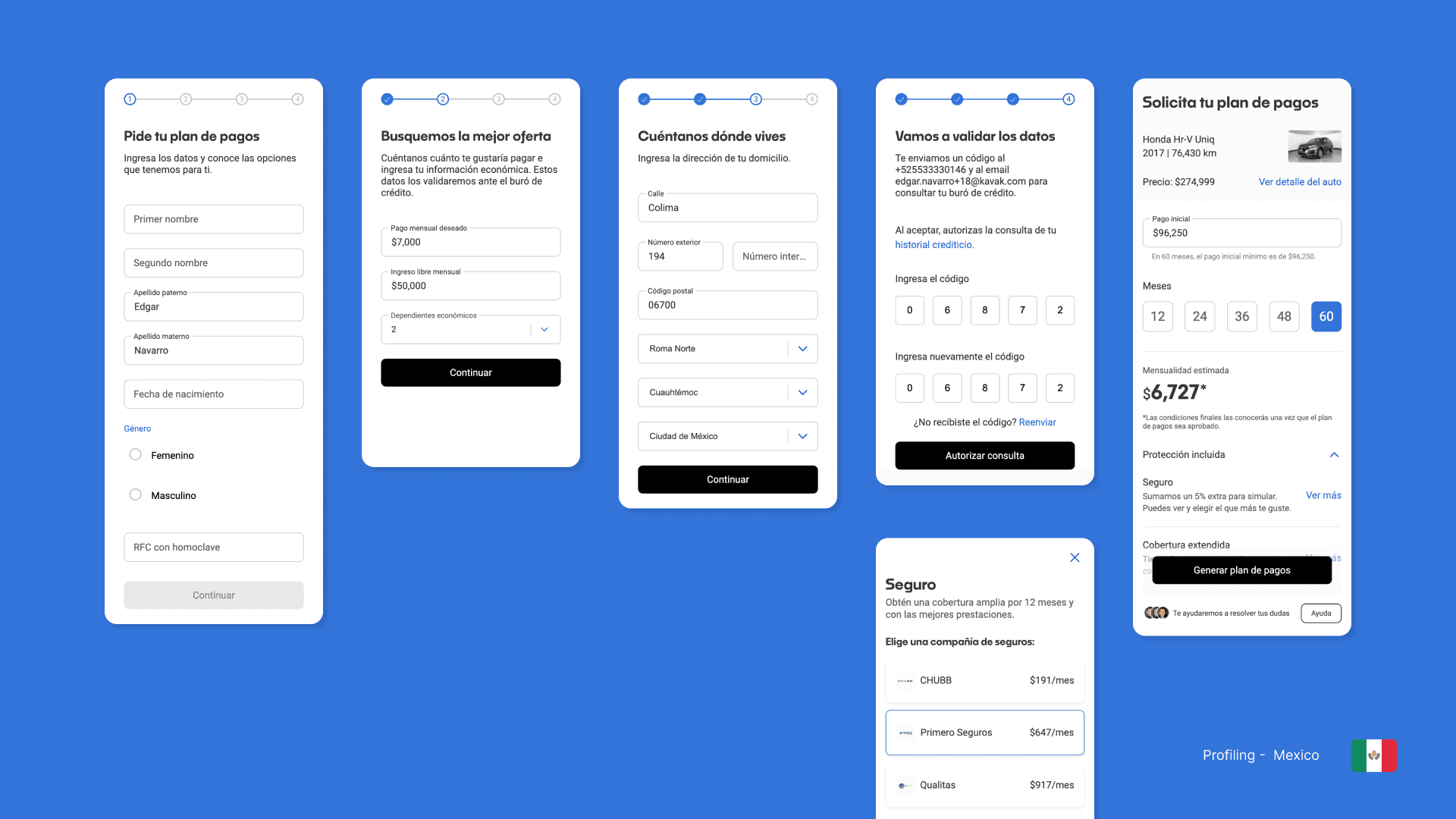

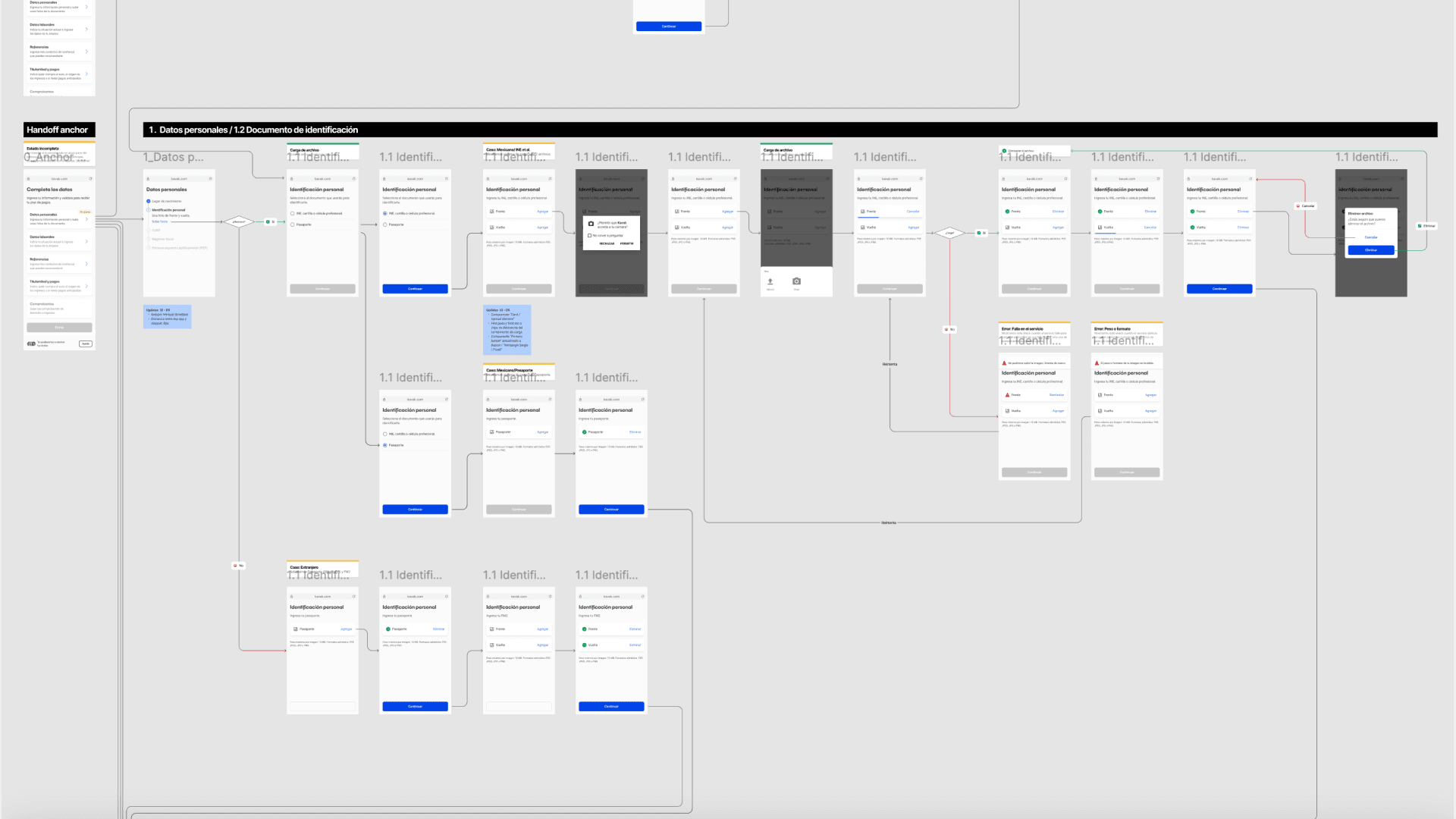

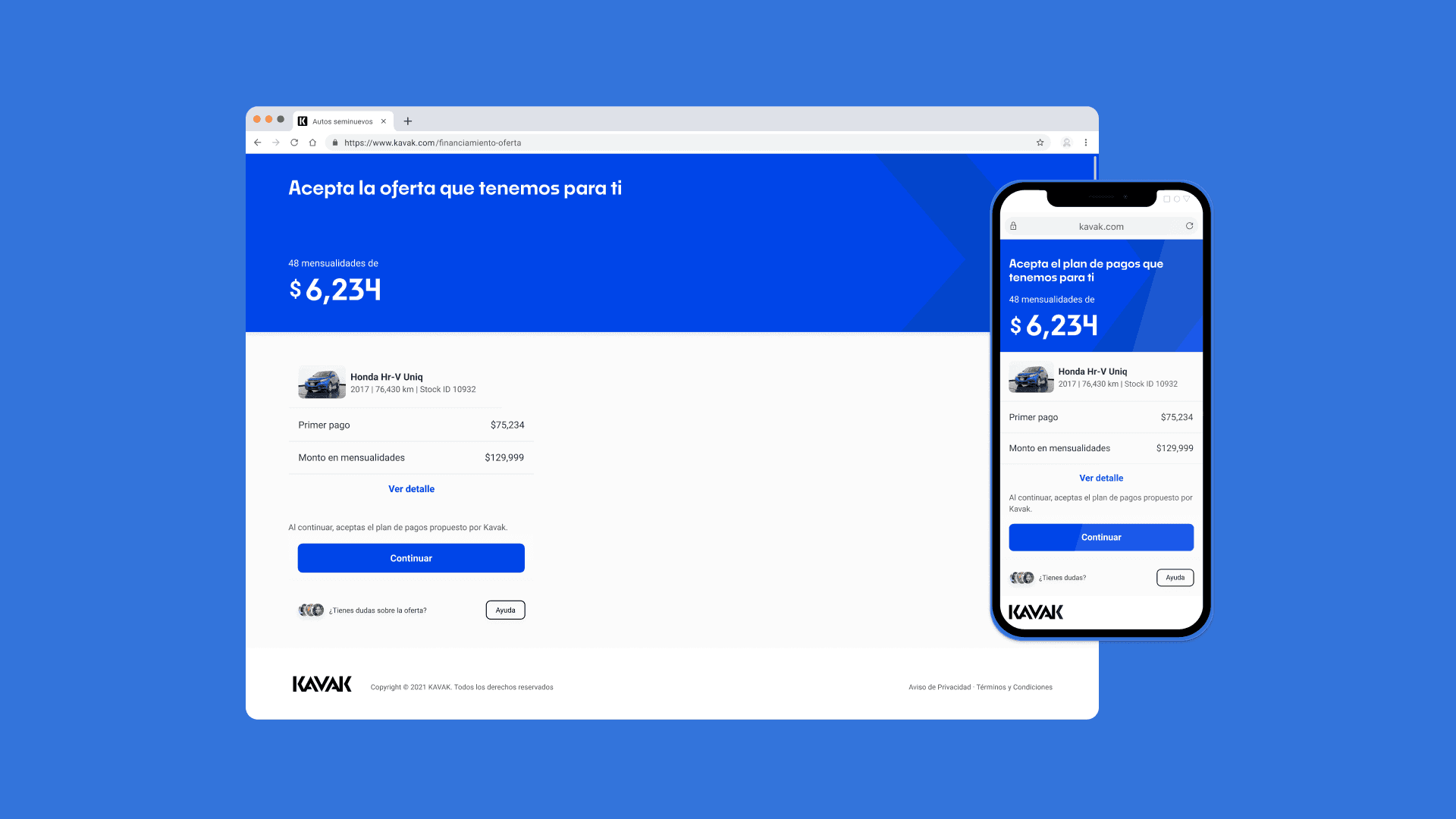

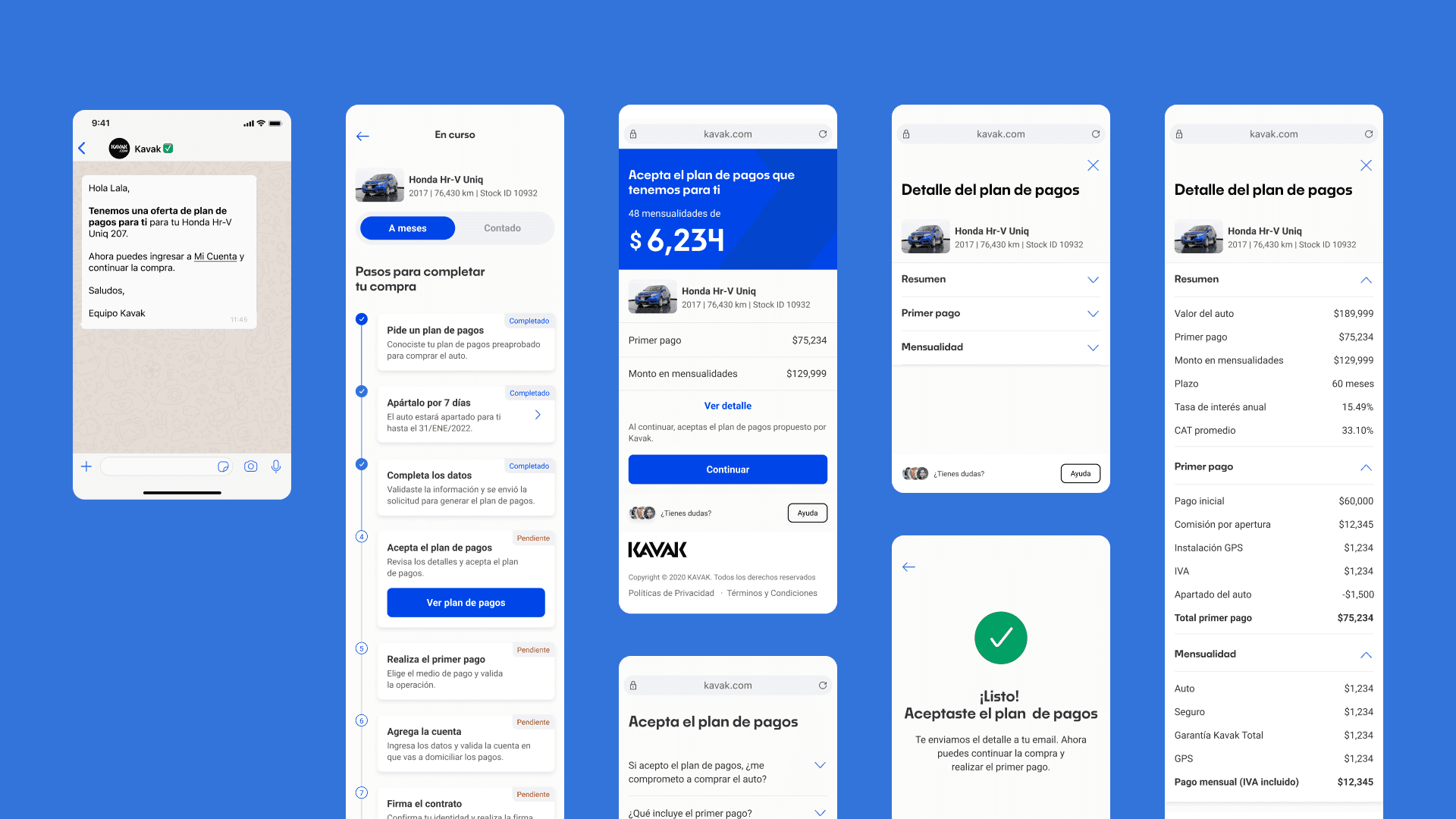

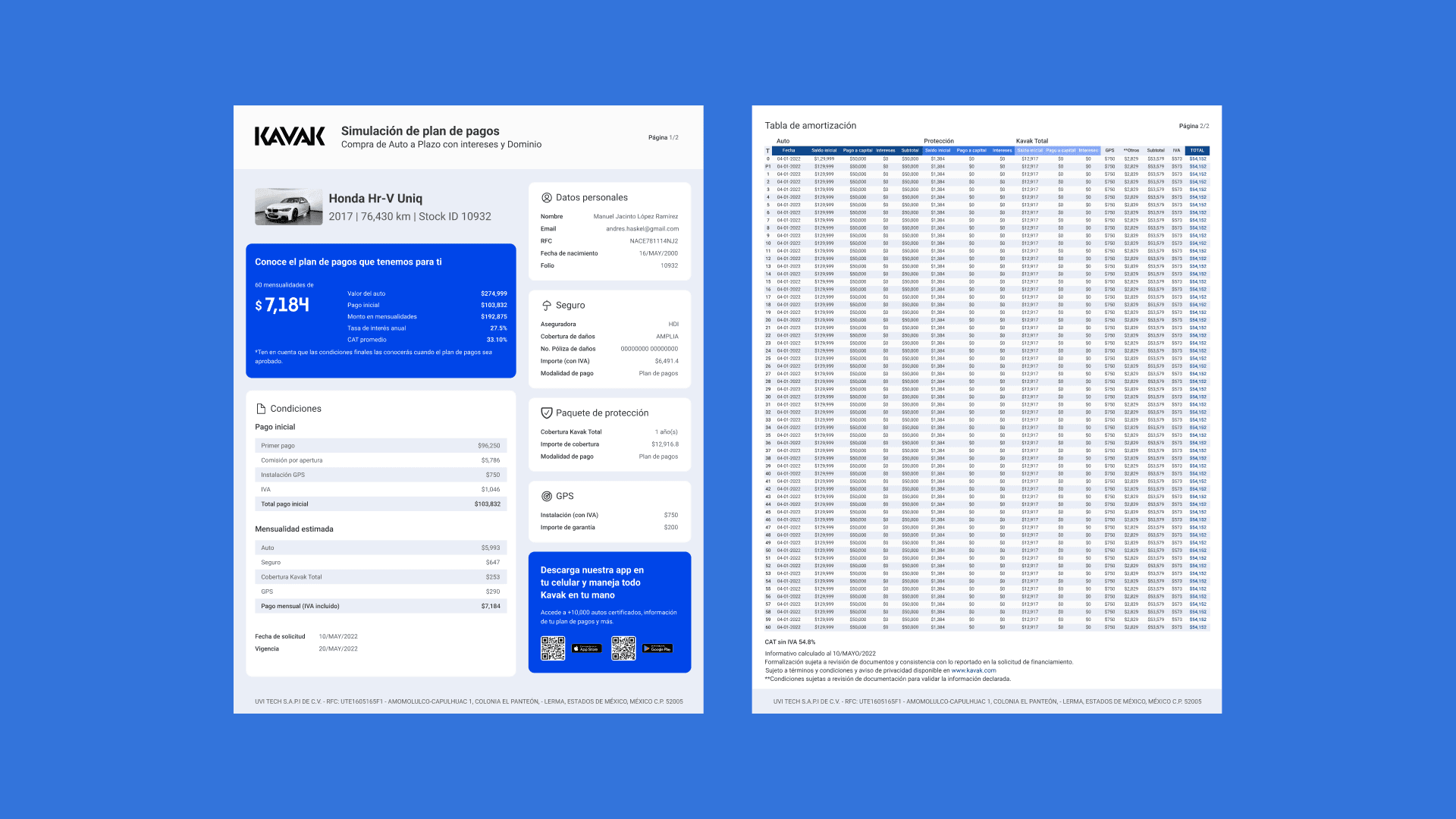

The redesign of the financing journey involved extensive user research, journey mapping, and usability testing to uncover pain points and identify opportunities for improvement. I developed tailored profiling funnels for Mexico and Brazil, adapting to the unique regulatory and cultural nuances of each market. I also optimized the personal data and formalization funnel, simplifying steps like document submission and verification to reduce friction and improve conversion rates.

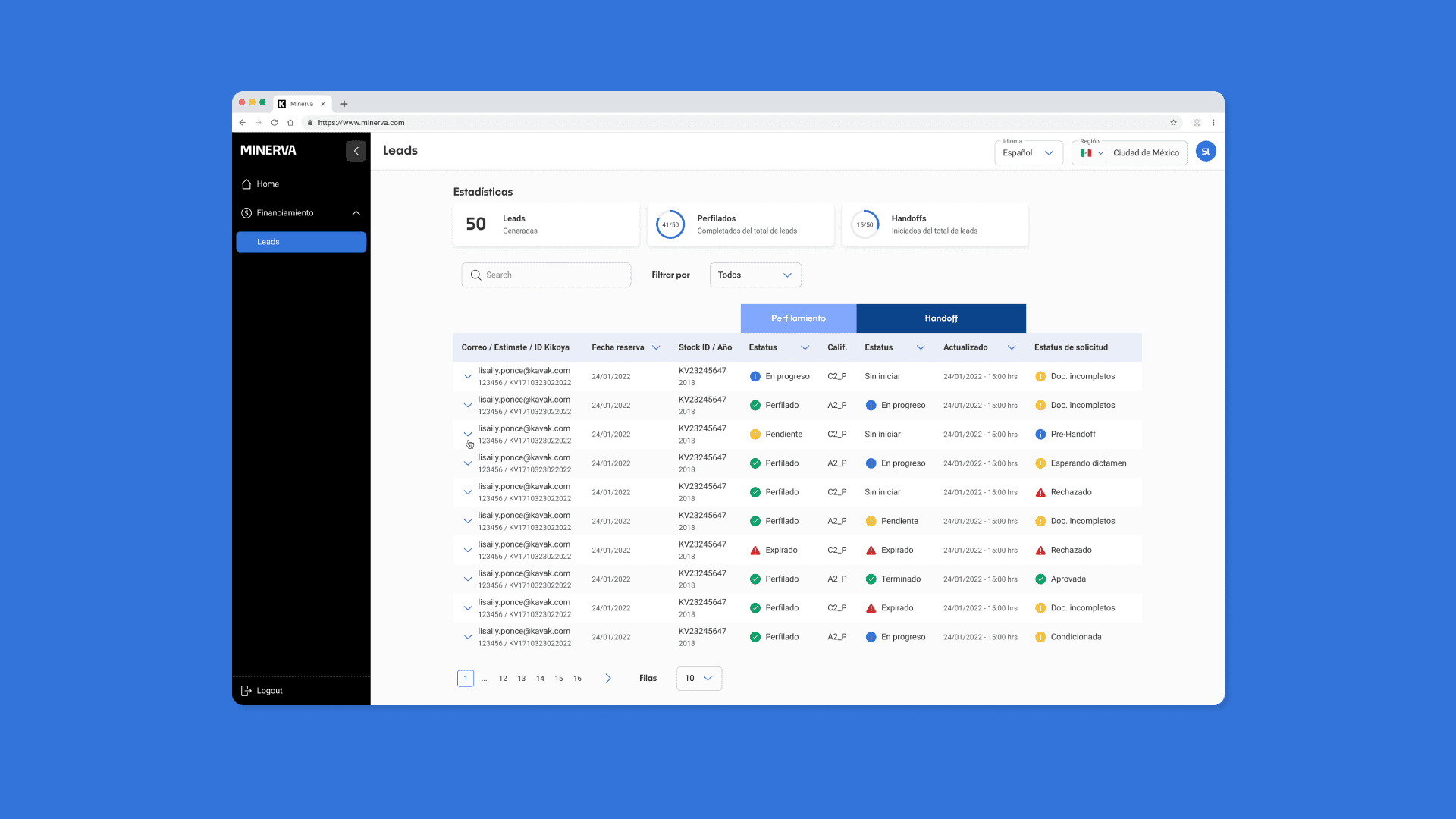

In collaboration with cross-functional teams, I designed automated processes for financing acceptance, initial payments, bank account integration, and proof-of-cents verification. Additionally, I ensured a seamless multichannel UX, enabling users to transition effortlessly between devices and communication platforms. To support internal stakeholders, I developed a leads dashboard that provided actionable insights and improved decision-making. These efforts collectively resulted in a 65% increase in conversion rates post-launch, demonstrating my ability to deliver impactful, user-centered solutions at scale.